new orleans sales tax rate 2020

SalesUseParking Tax Return French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019. 2020 Louisiana Sales Tax Holiday - Nobody likes paying taxes and November 20-21 2020 is an opportunity for everyone in Louisiana to pay a little less in sales taxes.

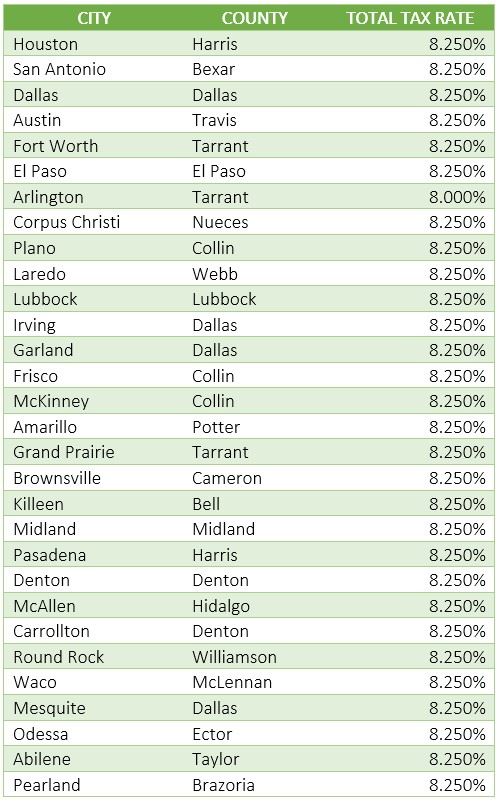

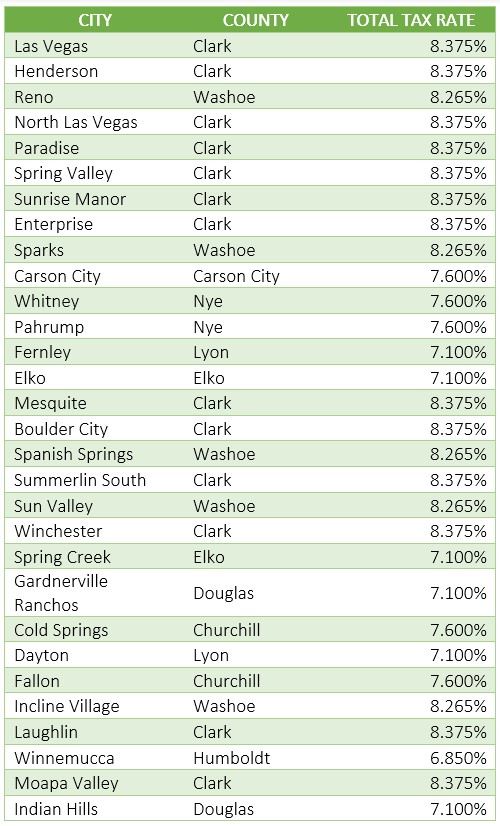

Nevada Sales Tax Guide For Businesses

Groceries are exempt from the Louisiana sales tax.

. Local sales tax rates can range from 0 to 85 depending on the city and parish. 2022 Louisiana state sales tax. Revenue at New Orleans gambling establishments topped 521 million in July 2021 an increase of almost 46 of what the properties brought in during July 2020.

The Orleans Parish Louisiana sales tax is 1000 consisting of 500 Louisiana state sales tax and 500 Orleans Parish local sales taxesThe local sales tax consists of a 500 county. This is the total of state parish and city sales tax rates. Table of Sales Tax Rates for Exemption for the period July 2013 June 30.

The Louisiana sales tax rate is currently. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. There are a total of 263 local tax jurisdictions across the state collecting an average local tax of 5076.

The New Orleans City Council announced the. Council votes on the tax rates and the 2020 budget as a whole at. The New Orleans sales tax rate is.

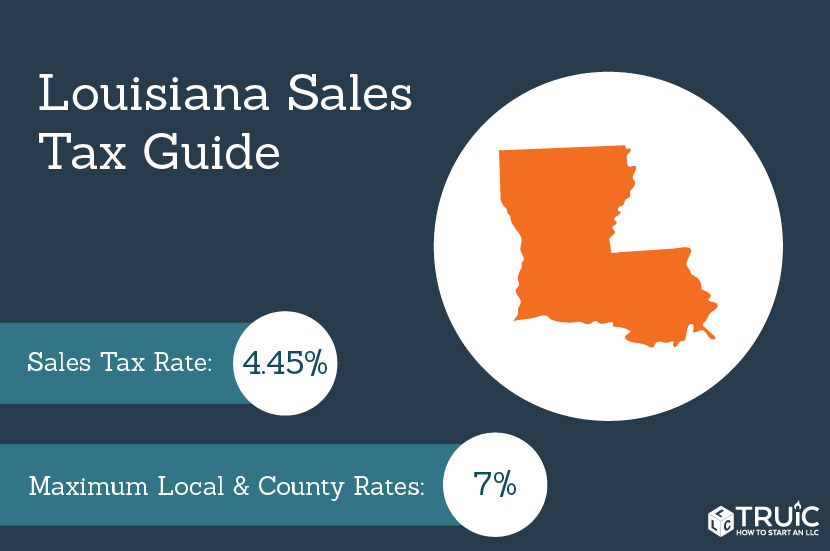

New Iberia LA Sales Tax Rate. The base state sales tax rate is 445 as of July 1 2018. Louisiana has a 445 statewide sales tax rate but.

Our Services Youtube San Diego Travel Guide History Lessons Pembroke Pines Realtors Expect These Neighborhoods To Sell Big In. Harrahs New Orleans shown. For example if you trade in your current vehicle and receive a 7000 credit on a new vehicle that costs 20000 you would only be required to pay sales tax on 13000 for the new vehicle.

New Rate Effective on all renewals on and after 1212019. A City county and municipal rates vary. Revenue Information Bulletin 18-019.

The definition of a hotel according to Sec. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. No notices at this time.

The sales tax holiday helps residents save a little bit of money on certain purchases. 1000 Is this data incorrect Download all Louisiana sales tax rates by zip code. What is the sales tax rate in New Orleans Louisiana.

Form 8071 Effective Starting October 1 2021 Present. Sales Tax Calculator. See R-1002 Table of Sales Tax Rates for Exemptions for more information on the sales tax rate applicable to certain items.

Counties and cities can charge an additional local sales tax of up to 7 for a maximum possible combined sales. Norco LA Sales Tax Rate. LA Sales Tax Rate.

2020 rates included for use while preparing your income tax deduction. Louis Missouri 5454 percent close behind. New Sarpy LA.

Diapers and feminine hygiene products are now exempt from half of the local sales tax in New Orleans Louisiana. 2 lower than the maximum sales tax in LA. Please contact the parish for a copy of the sales use tax.

You can print a 945 sales tax table here. The state sales tax rate was 4 for periods prior to. State Local Sales Tax Rates As of January 1 2020.

Sales Tax Forms. Click here for a larger sales tax map or here for a sales tax table. B Three states levy mandatory statewide local add-on sales taxes at the state level.

Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates. The latest sales tax rates for cities starting with A in Louisiana LA state. New Orleans lowers sales tax rate for diapers and tampons.

In the Orleans Parish which includes the city of New Orleans that rate for a meal prepared by a business would be 945 the combination of a 445 base state tax rate and a 5 local tax rate. Gail Cole Oct 15 2020. What salary does a Sales Tax earn in New Orleans.

Nightly Occupancy Fee-Permit R. New Orleans LA Sales Tax Rate. City of New Orleans Website.

Home new rate sales tax. For tax rates in other cities see Louisiana sales taxes by city and county. Revenue Information Bulletin 18-017.

However they continue to be subject to a 25 city sales tax and the 445 Louisiana state sales tax rate. Instead of a 2495 percent sales tax the new ballot initiative will be for a 245 percent tax she said. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Prior to July 1 2018 the state sales tax rate was 5 for the period of April 1 2016 through June 30 2018. New Roads LA Sales Tax Rate. New orleans sales tax rate 2020 Sunday March 13 2022 Edit.

The Parish sales tax rate is. Birmingham also has the highest local option sales tax rate among major cities at 6 percent with Denver Colorado 591 percent Baton Rouge Louisiana 550 percent and St. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7.

Tax rates are provided by Avalara and updated monthly. Click on links below to download tax forms relating to sales tax. There is no applicable city tax or special tax.

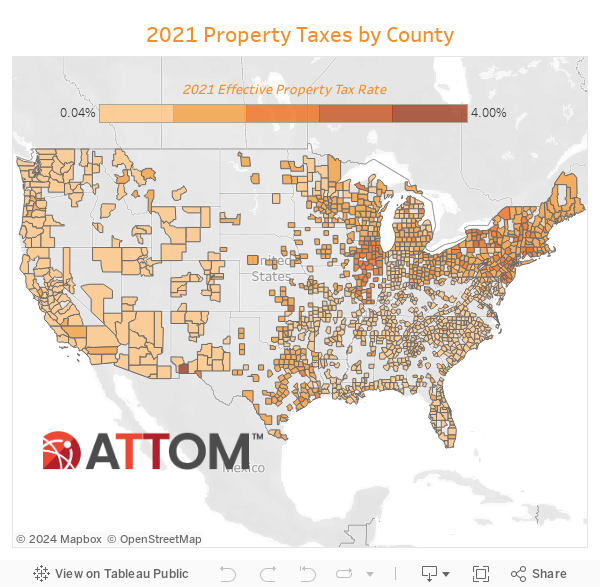

These rates are weighted by population to compute an average local tax rate. New Orleans overall property tax rate could be trimmed in 2020 under a. Rates include state county and city taxes.

Did South Dakota v. The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. The December 2020 total local sales tax rate was also 9450.

520 rows Average Sales Tax With Local. New Orleans LA 70112. California 1 Utah 125 and Virginia 1.

Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. As of July 1 2018 the state sales tax rate is 445. General Sales and Use Tax Report Effective 1012020 Short Term Rentals Tax Report Last Updated 10202020 Hotel-Motel Tax Report.

Sales Tax 1300 Perdido St RM 1W15 New Orleans. The New Orleans City Council approved the the 2020 budget and slightly lowered the citys overall property tax rate at its Thursday meeting. Exact tax amount may vary for different items.

The average sales tax rate including local and state in the Bayou State is one of the highest in the country at about 955.

Louisiana S 9 52 Sales Tax 2nd Highest In U S Biz New Orleans

Louisiana Sales Tax Rates By County

New Orleans Louisiana S Sales Tax Rate Is 9 45

Mayor News September 2021 City Reminds Business Owners Of Quarter For Quarter Sales Tax Collection To Start October 1st City Of New Orleans

How Property Tax Rates Vary Across And Within Counties Eye On Housing

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Sales Taxes In The United States Wikiwand

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

File Sales Tax By County Webp Wikimedia Commons

Sales Taxes In The United States Wikiwand

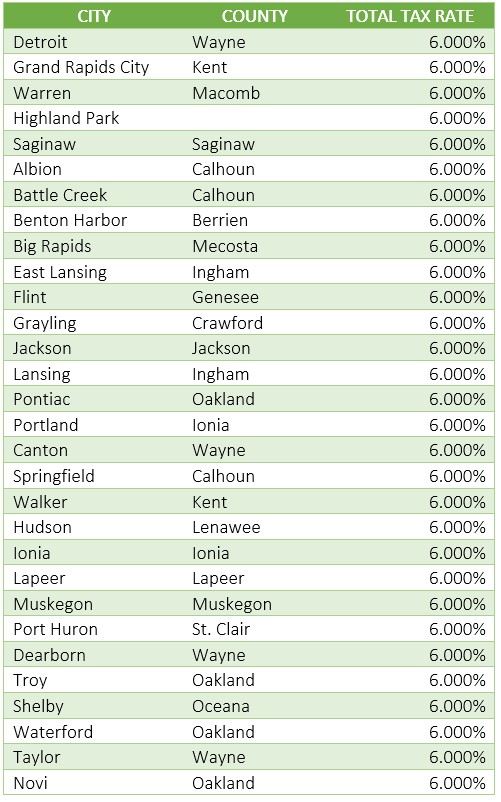

Michigan Sales And Use Tax Audit Guide

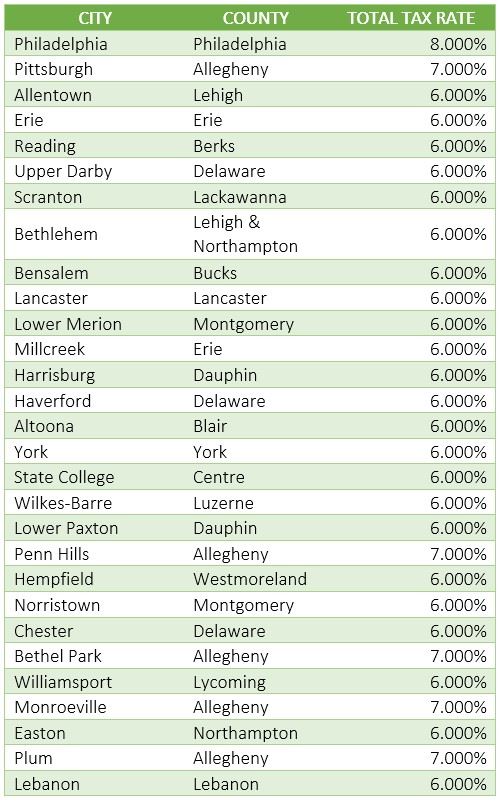

Pennsylvania Sales Tax Guide For Businesses

Sales Taxes In The United States Wikiwand

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Tax On Grocery Items Taxjar